What does a bitcoin speculator, a Rolex collector, a Magic the gathering cards collector, a wine collector and a tech growth stock investor have in common? Not that much they might think, but in my view something happened in 2019 that got all of these people exposed to the same something.

My previous post headline claimed that my watch outperformed my stock portfolio in 2021. I thought we should dig a bit deeper into that. I think most people by now are aware that low interest rates and stimulus pumped up asset prices all over the world. Equities and bonds are at record valuations at the same time, is something we heard for quite some time now. Of course it doesn’t stop there, crypto has created tons of newly rich people. House prices have soared in most places of the world, everyone who own anything seems to have done very well for themselves. A question that at least skeptics like me keep asking is: If the world did not get much better in terms of inventions or production of goods, how is possible we all got so much wealthier? So what? Its good times and the economy is running hot, what’s new? Well not everything has run equally hot, some asset price increases have been just off the charts the past few years. That’s what I want to dig deeper into. Also in in my stock portfolio some holdings have taken off like rockets whereas others have actually decreased in value or been flattish. So we know FEDs balance sheet has shot up like crazy in the past years and we know about the super low interest rates – but what distinguishes these certain sets of assets that just sky rocket?

To cut to the chase, the short version in my view is that we created a bubble. A new kind of, everything is a bubble bubble, which is pretty unique for how bubbles goes in an historical context. Usually bubbles are concentrated in something, like tulips, tech stocks or so. I don’t literally mean that everything is in a bubble, there are plenty of things out there at reasonable valuations. I just mean its a really freaking wide-spread bubble this time cutting across assets classes and countries. Let’s go back to my watch, which outperformed my stock portfolio in 2021 (and probably in 2020 too). I thought a lot about this, not really from the context of watch prices per see, but how risky assets re-priced in the past years. I have tried to look for patterns and would like to share some of the bread crumb clues I looked at. My conclusion is that what has sky rocketed in value the past two years, they all play to the tune of the same factor. In the past they didn’t necessarily really have that much to do with each other, but in the past two years, suddenly they did.

Finding the common bubble factor

What does a bitcoin speculator, a Rolex collector, a Magic the gathering cards collector, a wine collector and a tech growth stock investor have in common? Not that much they might think, but in my view something happened in 2019 that got all of these people exposed to the same something. “Something” was driving the action in their respective holdings the past 2 years. I call in the everything is a bubble factor. Let’s take a look at how price action looked like in the past years:

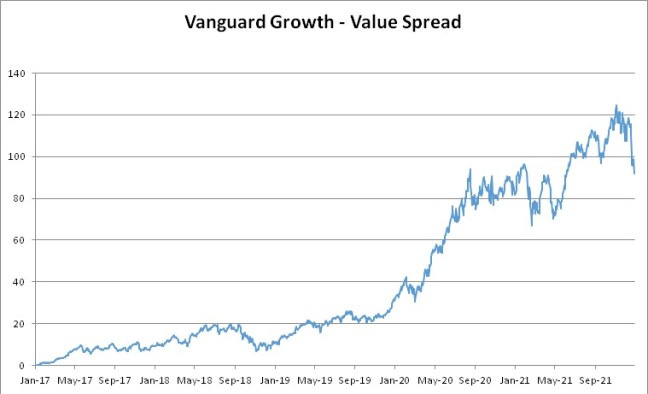

So I got onto this topic when my portfolio had outperformed the market quite significantly. I noticed that there were particular holdings that had extremely strong short term performance on very little actual fundamental company change. Back then most people only talked about how value investing is long dead and so on. But it was only when I plotted this graph in mid-2020 that I understood that growth stocks had just gone into hyperdrive mode. Around the same time some twitter names started to boast extremely good portfolio performances, they had portfolios fully exposed to this factor and were now bragging about their returns. As the ever contrarian I am, I got worried I was also just surfing on this factor – and not really created any actual alpha. With hindsight I shouldn’t have worried but rather piled into this more deeply myself, because this spread just kept delivering and delivering until about three weeks ago.

Just to be clear what we are looking at above, because I find this – sick, hilarious and just bonkers all at the same time. Above is the Vanguard ETFs which replicates the CRSP US Large Cap Growth & Value Indices. Buying the Growth Index and Shorting the Value index gave you a nice 20% outperformance between 2017-2019, a very strong out-performance on index level in the same market. That was probably justified as companies like Apple, Microsoft etc did improve fundamentals quicker than for example JP Morgan, Berkshire and Pfizer (companies found in the value index). But then in 2019 all of a sudden in 2 years time the growth companies went up 100% more than the value companies. How is that possible to be even close to reasonable? In my book its not, markets ran way way ahead of themselves. Let’s look at some of the other “assets” to see if we can see a pattern between this Growth-Value spread and the rise of other assets:

Watches

With a bit of lag to the Growth-Value spread grey market prices of watches seems to take off in a very similar pattern. Look at the AP Royal oak which basically doubles in value in about 1 years time. These watches are now selling for multiples of what they cost in the store (if you are lucky enough to be allocated one). So should we be buying stocks or just hold physical portfolios full of Audemars Piguet watches? Historically these watches have been good store of value, basically rising with inflation, Rolex is famous for this over long periods of time and much of its special status is probably due to this good second hand value. But now we are talking about watch prices doubling in the span of 1-2 years, trading over 2x the retail price. Rolex produces roughly 800 000 watches per year, which are sold at retail (in some few cases the retailer might do some shenanigan’s to extract some of that grey market premium but most often not). These watches have supply constantly coming into the market but still the demand is so much larger than supply that these watches can catch such premiums. To me this is again just bonkers and typical bubble sign. So how about my watch? I did not in fact buy either a Rolex or a AP but my watch has had a similar trend as these. For the avid twitter stalker and watch enthusiast you can figure out what I got 🙂

Wines and Champagne

Again we see the second hand prices of rare wines just taking off (after flat lining for many years). It’s clear people suddenly got so much more disposable income and everything went into scarcity as people bid up prices rapidly. Although the scale here is not like other assets a double or triple just a “meek” 30% increase, its still pretty significant for somethings so large as the average prices of the whole worlds stock of fine wines.

Magic the gathering cards

One of my person favorites, collector cards from MTG. I still have my collection in my parents home, just like the price of the most famous card in the picture here, the Black Lotus, my collection has roughly tripled in value over the past 2 years. My parents who are very frugal do not really have anything expensive in their home. Somehow my mom anyway got a bit irritated when I messaged her and said that box of cards tucked in away in one of the wardrobes is probably the most valuable item they have in their home. Just wanted to give a small FYI reminder to be careful with them but that was apparently insensitive saying they didn’t have anything of higher value than my Magic cards – sorry mom!

Bitcoin

And finally “everyone’s” favorite asset class over the past years, for extra clarity I merged the graph with my Growth – Value spread:

The trend is so clear so no further arguments are really needed, this spread and bitcoin trade on the same factor – the bubble factor.

Why bubble?

So why do I say bubble factor? It’s because its impossible that things so very different like Rolexes, Magic cards, fine wines and bitcoin all have something so fundamentally in common that they should all reprice to multiples of what they traded on before at the same time. There must be an underlying frenzy/inflation or similar driving these gains. And although we have seen inflation it has not been anything near these levels of gains. Many of these assets like Rolex, Magic cards and fine wines, have 20+ years of price history showing very stable pricing, how is it possible that they all should reprice at the same time? It’s very clear to me that the combination of stimulus money and sitting at home locked down through Covid measures created this momentum frenzy into all kinds of assets. This fed on itself and prices on pure momentum/FOMO continued to move higher. As all bubbles unfortunately they always come to an end..

This is the Growth – Value spread over the past 3 months, I wonder how second hand watches will perform the coming year? 🙂

Watches prices are insane, even the platinum daytona price doubled! And it’s a 55k€ watch..