Time to reveal my first investment in a truly Japanese company (that is bought with Yen and only listed in Japan). What really triggered me to pull the gun was the significant JPY weakening we have seen lately, with only domestic sales I’m fully exposed to the Yen in this holding, let’s dig into Anicom Holdings!

Elevator Pitch

- Dominant insurance company in it’s niche of pet insurance in Japan (estimated 44% market share).

- Strong growth: 10 year Revenue CAGR of 14% and 5 year of 6%.

- Founder led with CEO who still holds about 8% of outstanding shares.

- Core of the thesis is really about Japanese mindset change of the role the pet has in the family. This will over time increase insurance penetration.

- Moat built from highest coverage of direct settlement of bill at veterinary as well as regulatory barriers for insurance companies.

Pet industry in Japan

Anicom has been responsible for much of the growth in the Japanese pet insurance market over the years, however there are still relatively few pets covered by insurance at this time. According to figures from a 2020 Japan Pet Food Association survey of dog and cat ownership, there are roughly 18.1mn dogs and cats kept by Japanese households as pets, and only about 12% of these are covered by insurance. The UK has 16.5mn dogs and cats (8.5mn dogs, 8mn cats; about 25% of the human population in 2017) but pet insurance covers more than 25% of UK pets. So adjusted for population, UK has about twice as many pets and twice as high rates of insured pets. If Japan overtime would reach UKs level of number of pets as well as insurance penetration that is a four fold increase of the market.

As you will see below, the number of pets owned in Japan is in a rather steady state (dogs decreasing, cats increasing). Considering that the population has decreased with a few percent in this timeframe and will continue to do so, is a natural headwind. As a tailwind is that interest in pet ownership is up, but somewhat held back by the supply of especially dogs. There is a more interesting story than the steady state of pet ownership and that is around the mindset of the owners. As you also can see below the industry keeps growing in size although number of pets is not growing. We can only attribute this to the changing mindset around pet ownership. More and more pet owners puts the pet in a family position, where no costs are spared for the pet to have a good life. As a US pet insurance CEO put it: In the past 20 years pets have moved from the backyard to inside the house, and now they are moving from the house into the bedroom and even on to the bed. Press to read more..

So the upside is two-fold:

1. If pet-ownership levels in general would increase, more in-line with western world. Currently we do not see anything in the data suggesting this.

2. The trend of pet owners spending more on their pets continues. The data clearly shows that more money is spent on the pets and as such growth in pet insurance should converge towards UK levels over time.

Pet Industry Size stable

Pet Insurance Growing nicely

As the mindset changes around pet ownership, a big part of that is going to an expensive veterinary when the pet gets sick. As you realize you could face some large bills, the incentive to get a pet insurance increases a lot. As we can see that starting at very low levels in 2016, pet insurance penetration in Japan has taken off in a big way, with Anicom being the major beneficiary and probably also driver behind this growth.

The below survey, gives a good picture of costs for dogs and cats in Japan. One would perhaps assume food is the major costs for a pet, especially dogs, but treatment for sickness and injuries + insurance premiums significantly outweighs food. Although owners seem to spend a lot on shampoo and grooming overall for dogs + cats no other categories are close to the same spend as health+insurance related costs. This is something to keep in mind for anyone interested in exposure to pet related investments.

Background and founder

In 1992 Nobuaki Komori, the founder and CEO, joined Tokio Marine & Fire Insurance after his graduation. In 1999 after helping his brother setup an animal hospital the thought came to modernize the pet insurance industry. In 2000, he left Tokio Marine and established Anicom Club, which handles the “animal health insurance mutual aid system” (meaning not a fully licensed insurance company). With 40 million Yen in capital it was a tough start. Soon after its founding, the company experienced rock bottom to the extent that Nobuaki declared its dissolution. But with some luck of last minute VC money a well placed news article about a new pet insurance and the cooperation of those around him, he slowly but surely put the business on track. In 2006 the Insurance Business Law was amended, Anicom had three options: to become a life/non-life insurance company or a small-amount, short-term insurance company (sales cap of 5 billion yen), or to exit the business. Anicom applied for a non-life insurance business license and obtained the license in December 2007. Anicom then established Japan’s first non-life insurance company specializing in pets. In January 2008, Anicom General Insurance Co., Ltd. began selling pet insurance. Nobuaki holds about 8% of the outstanding shares today.

In the early days Anicom’s market share of pet insurance was as high as 60-70% and the company grew policies and revenue very fast. The market share has now shrunk to slightly below 50% so competition has come in but its still a very impressive market share in a growing market.

How Anicom insurance works

Sales channels

If we look at newborn pet as the starting point of insurance sales, pets come from three main categories: Pet shops, breeders market or family/friends/strays. Breeders mean for example an online platform consolidating small scale breeders of pets. According to 2019 Economic Census for Business Activity there are 5,041 shops that sell pets and related goods in Japan. Anicom had agency contracts with 1,997 (about 40% of all pet shops) at end-March 2018. About 60% of all new Anicom business comes through the pet shops (agencies). The below picture tries to show what market Anicom captures among newborn pets in terms of number of policies written. In total Anicom has about 1 million policies outstanding.

Obviously the largest market (which is harder to captured) are all the existing pets that are not insured or where pets are received from family/friends. Although some insurance sales happens for older pets, it is less common than policies written for newly acquired newborn pets. Anicom has been strong in the pet shop sales channel as well as more lately focusing on the breeder channel. The breeder channel was significantly strengthened through the purchase of SIMNET in Dec 2019, which runs multiple breeding matching websites. The company acknowledges that its been late to the game in the direct internet sales channel. Only in the past years has the company focused on building up the direct sales through internet. Probably this is one of the reasons for loss of market share to competitors.

An emerging risk, or at least change of the sales landscape is tied to how Japanese views of animals are changing. The Animal Welfare Law is revised about once every five years, and there are voices calling for a ban on Japan’s unique display sales at pet shops. If so, there is a possibility that the current sales method at pet shops will be restricted in the future.

When Anicom receives applications from its general sales channel other than pet shops, the company conducts screening based on the animal’s breed, age, health conditions, and health records submitted by the owner. The pets that pass the screening are required to go through a waiting period of 1.5–2.0 months before the policy is signed. The waiting period is required to prevent payouts for any preexisting conditions. The company does not screen store-bought pets that are less than one year old. The company considers such pets virtually risk-free. The natural point to sign up a pet for insurance is then when its just new-born and purchased by the owner.

Insurance with 50% or 70% co-pay

The insurance is sold where Anicom will pay 50% or 70% of the veterinary costs. This model is good for multiple reasons. Since the insurance buyer still partly pays themselves, that will align interest to not unnecessarily bring their pet to the vet. With the conventional business model in which policyholders mail their claims to the insurer, each case incurs administrative costs such as bank transfer fees, postage, and assessment costs. The OTC payout system reduces these administrative costs.

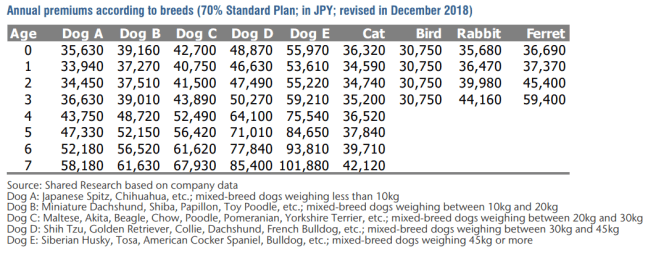

Below are example of premium levels:

OTC insurance settlements

Anicom was the first in Japan to establish a system that allows policyholders to pay only their co-payments by presenting their insurance cards at the counter. This has most likely been the key feature of Anicom’s success in the Japanese market. There are still only three companies in Japan that offer OTC payout settlements at hospitals: Anicom, ipet, and Pet & Family. These settlement systems also help the hospitals attract customers. Anicom’s network has grown to 6,700 hospitals (more than 50% of all animal hospitals in Japan) that accept the insurance settlement system. Of the annual 4 million claims received, roughly 85% are settled over the counter.

Business Outlook

The Covid period made a lot of people re-evaluate their lives and also stopped people from travelling. It’s shouldn’t be news to anyone that pet ownership has increased in popularity, so also in Japan. If anything pet ownership in Japan has been somewhat held back because there has not been enough supply of animals, meaning prices have increased. In a survey made for thousand Japanese in 2021, 19.9% of people started keeping pets after 2020, 2018 (8.4%) and 2019 (9.3%). In the same survey of those who do not have a pet (69.2%), 34.7% want to have one.

Forecasts vary quite widely and its also hard to find Japan specific forecast of the pet insurance growth rate. But depending on who one wants to listen to growth rates are forecasted at a CAGR between 6-14% for the market in the coming 5 years. Equity analyst forecast Anicom growth at around 7-8% and newly listed competitor IPET at 9-10%, so Anicom is a bit on the lower end compared to IPE and market CAGR forecasts. Still 7-8% growth is a very decent level if achieved.

Listening to management Q&A, they are currently in a shift from mostly working with pet-shops to the breeder/online channel. At the same time Anicom is planning to reduce the quite fat agency commissions pet shops have previously enjoyed. Herein lies of course a risk also that competitors come in with a better offer. This is also related to the wider discussion on how pet-shops should be allowed to sell pets. Anicom is kind of de-risking it’s sales channels by focusing more on the breeder sales channel. If this is successfully balanced this should increase operating margins going forward.

Anicom Second Founding

Anicom has set out on a quite ambitious widening of its scope of businesses, some of the projects are VERY ambitious.

Many of the very ambitious initiatives are related to gut bacteria and other genetic/DNA analysis, which can be used to improved the animals health. All illnesses in pets are caused by a combination of genetic and environmental factors. Anicom says that diseases caused by

genetic factors are even more common in pets than in humans. However, hereditary diseases can be prevented through genetic screening and other technologies, so Anicom has launched a genetic screening business and is striving to eradicate hereditary diseases. Ultimately, if it can eliminate the genetic factors from the equation, it can control its annual insurance payouts. The step from such research do actually coming up with products that significantly improves pet health, seems to me to be VERY ambitious. For example the company launched different pet food initiatives. The first version launched is a very expensive tailor made food (based on the DNA analysis) for the animal in question. For customers willing to pay such premium for their pets food, one should probably rather try to make money on the food itself, than that this has potential to improve insurance margins. To me it sounds like a very very niche product.

Although some projects are ambitions, others make a lot of sense. Given how integrated Anicom become with owning breeder platforms etc, some of the ventures listed in the picture above seems good. The more recent launch of a more normal pet food, that should be healthy for the pets. That does not sounds like a too unreasonable cross sell to existing policy owners. What I do think is positive with these type of initiatives is that the company is not just resting on its comfortable market position, it really tries to continue to innovate. I don’t fully believe in all of these ideas, but if half of them becomes successful it might still have been a worthwhile venture as long as not too much money is poured into these projects.

Competition

In terms of the number of policies in force, Anicom is the No. 1 player in the industry with Ipet Insurance as No. 2 and Pet & Family as No 3. Ipet is the player that really has gained market share on Anicom with a very similar model as Anicom’s. As previously mentioned it is probably Anicom’s lack of focus on sales through the direct online channels that has made Ipet catch-up in terms of policies outstanding. Perhaps also to some degree price under-cutting by Ipet, since their margins are much worse than Anicom’s currently.

This massive table gives a good long term overview of the competitive landscape, click to enlarge. I would be interested investing in Ipet as well, which shows a more impressive growth rate and has a female CEO (must be so unusual in Japan). But Ipet recently listed and still has a high valuation more in-line with Anicom’s valuation a few years back. Since the valuation is a bit to aggressive I find Anicom’s case more attractive and more de-risked as the larger more mature company. We are still talking about an industry with nice tailwinds, which as can be seen by below table is lifting all boats.

One detail from this table is the Net loss ratio, which is higher for Anicom. The reason I have found for this is that Anicom has a more mature base of pets and as the pets gets older, the claims increase. This is also something to keep an eye on also from the perspective in policies would start to stabilize or decrease, that could mean that the loss ratio would be creeping up as the average portfolio gets older. Maybe one of the few larger negatives I have found with this case.

Financials

What is hard to judge is how cyclical pet insurance is, since it’s both a new industry in Japan and we have not seen a proper down-cycle in a long time. One should also mention that for non-JPY investors, this is also a massive bet on JPY, since all income and cost is domestic. Will the argument of the pet being a family member hold when times are tough and money is tight? That will probably vary and in a really bad market for sure there must be some cyclicality, but I do not believe this to be a highly cyclical business.

Valuation

Anicom holds quite a lot of cash on it’s balance sheet, this is also partly needed from regulatory perspective to cover claims. This reduces the risk in the case a lot, since the cash covers almost half of the market cap for the company. In general pet insurance is a claims intensive business as pets will visit the vet often multiple times per year, this creates a steady stream of premium income and claims outlays, meaning there is less off a float as some type of insurance businesses can thrive on. The cash in Anicom is instead mostly accrued from the free cash flow and some smaller capital raisings.

Looking at multiples Anicom has come down from a quite high “growth” stock valuation to a more reasonable valuation over the past years:

Conservative DCF Input:

Base case (50% probability): 6% Revenue CAGR for 10 years, almost doubling revenue with slight margin expansion.

Bear case (25% probability): 3% Revenue CAGR for 10 years, with significant margin contraction due to aging pet portfolio and underestimation of costs and competition.

Bull case (25% probability): 9% Revenue CAGR for 10 years, more than doubling revenue, Japan insurance penetration reaching close to UK current levels. Operating margin goes from current 6 to 8%.

In all cases the discount factor (equity risk premium) is at 10%.

Gives a weighted target price of 753 JPY vs current price of 601 JPY, so about 28% upside. For me who have very little JPY exposure I’m fairly happy getting some exposure to Yen when it’s so extremely weak towards the USD. I see the JPY rather as a added bonus to the case than a problem.

Hope you liked this first fully Japan case, with no exposure to anything but Japan! Let me know what you think, perhaps you have looked at Trupanion which is an interesting US case in the same industry.

Thanks for writing about a japanese company. I agree with your valuation, without knowing much about japanese culture or the industry.

I guess you know already the Robert Vinall interview with the Trupanion CEO. Especially the Q&A part is interesting:

https://www.youtube.com/watch?v=q25eUpPxYmY

And here is a nice video about Anicom from the perspective of the two bunnies Mugi and Hop.

https://www.youtube.com/watch?v=Kut-s3q2Fsc

In the comment section they mention “Many pet insurance companies will only cover dogs or cats!” and apparently Anicom insures also birds, bunnies and ferrets.

Thanks Chris!